STOCK CERTIFICATEs

An easy inexpensive method

to increase corporate validity

and business value

Use Physical High Quality Stock Certificates

The fractional general counsel lawyers at Whale.Law recommend and issue formal physical stock certificates to the entities we represent. This is for several reasons. Physical Stock Certificates will:

-

Increase the monetary value of your business in the event of a merger, acquisition, or sale,

-

Physical Stock Certificates are low in cost,

-

Give a greater appearance of legitimacy to investors

-

Afford greater protection of your personal assets from corporate liability

-

Better formality between owners

-

Reduced exposure to lawsuits to Pierce the Corporate Veil

-

Better Differentiation from other forms of stock, such as tokenized shares

Do I need a physical Stock Certificate or will an Electronic Stock Certificate suffice?

“Dematerialization” is the term for the general trend for the replacement of physical stock certificates with electronic stock certificates. Time, cost, and destruction risks associated with a physical asset are reasons for the trend toward electronic stock certificates. Still, presently, ninety-four percent (94%) of corporations issue physical stock certificates. Most physical stock certificates are possessed by the United States’ Central Securities Depository (DTC).

There are many uses for corporate formalities, not the least of which are the increase in the market value of your business and the protection of your personal assets from legal liability. Failing to issue a physical stock certificate, by this very limited measure, places your business in the bottom six percent (6%) of companies. It is better to make progress when it is easy, inexpensive, and useful. This is the reason we recommend and prepare physical stock certificates.

There is a general trend for the replacement of physical signatures for electronic signatures. The Uniform Electronic Transactions Act formalizes this process. Weaknesses in this system include risks of fraud, forgery, and risks attenuate to centralization.

Blockchain Technology may reduce Electronic Stock Certificate Risks

Blockchain technology promises a solution to several risks inherent in electronic stock certificates. First, fraud can be reduced by a ubiquitous resource showing company ownership, time, degree, and terms on a blockchain trustless database. Second, forgery risks will be lessened if every stock certificate is represented by a unique, traceable notation on a blockchain (an NFT non-fungible token or ERC 721). Third, problems with one centralized entity possessing stock certificates are reduced by a decentralized blockchain ledger.

Blockchain is Impractical for Stock Certificates, presently

-

First, scalability is an issue as the number (volume) of shares traded back and forth exceeds all but the fastest blockchains.

-

Second, speed is an issue as liquid trading back and forth of stock ownership necessitates lightning speed, which impedes blockchain stock certificate adoption.

-

Third, cost is an issue as “gas fees” and like expenses quickly exceed the utility of blockchain accounting of stock certificates. The speed and volume of stock trading presently makes blockchain use economically inefficient.

-

Fourth, security is an issue as bugs in blockchain platforms (such as 51% attacks) do not give business executives sufficient trust in blockchain technology for them to delegate the accounting of the ownership of their companies.

Stock Certificates in the future may be represented on blockchains if and when these technical challenges are solved.

Tokenized Stock Shares verses Common Shares

Tokenized Equity is commonly known as tokenized stock shares. They may also be known as digital “coins.”

They are digital references on a blockchain known as tokens. Tokenized equity shares represent an ownership interest in a legal entity. Tokenized equity shares are easy and cheap to create. Tokenized equity is frequently employed in the form of initial coin offerings (ICOs). Crypto and blockchain businesses issue these forms of blockchain company ownership, usually during the formation of the business. It is a means to:

- promote the business

- raise initial company equity

- increase the market capitalization (value) of the company over time as tokenized equity coins rise in value

Blockchain tokenized equity stock shares and traditional common (or preferred) stock shares differ. The relative regulatory legal requirements of tokenized equity stock shares are uncertain. Compliance requirements in the future may come from:

-

Commodities & Futures Trading Commission (CFTC)

-

Securities Exchange Commission (SEC)

-

European Securities and Markets Authority (ESMA)

-

Financial Crimes Enforcement Network (FinCEN)

-

US Department of Justice (DOJ)

-

Financial Industry Regulatory Authority (FINRA)

-

various other country and state legal entities

Differentiate Between Common Stock Shares, Preferred Stock, and Tokenized Equity

Physical Stock Certificates will help a Crypto Blockchain business differentiate its common stock shares from tokenized equity stock shares. This is important to keep distinct the rights and privileges of the various types of company owners. For example:

Common stock owners typically have voting rights. Preferred stock owners typically do not vote. Do blockchain tokenized equity coin owners?

Common stock owners typically share in fluctuating corporate dividends? Do blockchain tokenized equity coin owners?

Preferred stock owners typically share in set corporate dividends? Do blockchain tokenized equity coin owners?

What is the expected price volatility between common stock holders, preferred stock holders, and tokenized equity stock coin owners?

What are the notice requirements to business owners between traditional stock owners and tokenized equity stock coin owners?

What are the business information disclosure requirements to tokenized equity stock owners? Do they differ from the disclosure requirements to common and preferred stock owners?

A Certificate of Designation

We recommend a Certificate of Designation be created. It is filed with a governmental entity, usually in the businesses’ State of Incorporation. It is a publicly available document. The Certificate of Designation specifically sets out what the tokenized equity stock gives the owner and what it does not give the owner. The Certificate of Designation:

adds clarity,

reduces potential legal liability from stock owners,

reduces the likelihood of regulatory action against the crypto blockchain business, decreases the chances of conflict with tokenized equity owners,

increases owner knowledge of what their place is within the structure of the corporation

Reduces conflict during a merger, acquisition, or sale.

A properly prepared Certificate of Designation will alleviate many problems created by the conflict between common stock, preferred stock, and tokenized equity.

What is a Stock Certificate?

A stock certificate is a physical representation of a legal interest in a corporation. It is the relative interest expressed as units of participation in an entity’s value, and profit. It is an intangible interest. A stock owner of 50% of a corporation cannot show up one day and trade the certificate for 50% of the corporation’s “stuff.”

Stock Certificated Names

Stock certificates go by several names, such as:

Stock Certificate

Certificate of Stock

Share Certificate

Stock Certificate Types

There are two types of Stock Certificates:

Registered Stock Certificates, and

Bearer Stock Certificates.

The legal interest comes in several forms, which include:

Voting stock shares,

Preferred stock shares, and

Common Stock Shares

Types of Entities that Issue Stock Certificates:

Stock certificates are not limited to pure corporations, any legal interest with a divided interest in its ownership can issue stock certificates. Types of entities include:

Corporations (Co., Corp.)

Limited Liability Corporations (L.L.C., L.C.)

Joint Stock Company (the historical first name for corporations)

Uncertified Stock Shares

Nearly all owners of corporate stock possess “uncertified shares.” No physical stock certificate comes with an uncertified share. These are ownership interest in traded entities where the issuance is at an electronic stock register. The benefits of Uncertified Stock Shares are speed, cost, and convenience.

Interpreting a Stock Certificate by Sight

Each certificate of stock has a number assigned to it. The number represents the degree of ownership the stock certificate owner has in the corporation, which is the number of shares the certificate states, divided by the total amount of shares outstanding, which the certificate may or may not state.

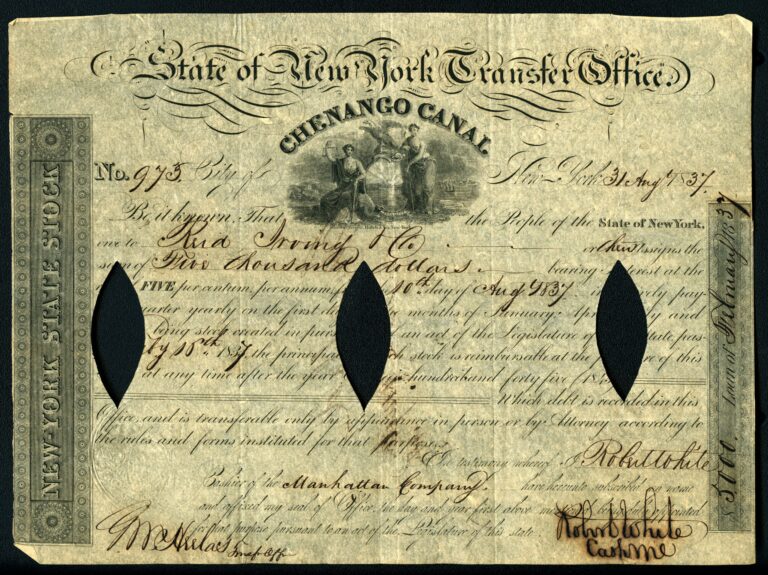

The History of Stock Certificates

The systems of business ownership we enjoy today began with paper evidence of the ownership of each business entity. When business ownership changed from person to person (or entity to entity), reliable paper evidence memorializing the ownership change was needed. In came the stock certificate, like money, represented by the business industry as reliable, physical evidence of ownership.

The first corporations, known as joint stock companies, were more like business clubs. Ownership could not be transferred except by consent of the other owners. This is because early medieval law banned the “assignment of intangibles.” This was no liquidity of corporate shares. Stock Certificates were not like money, or bearer bonds. A Stock Certificate gained value only when it was represented on the official accounting books of the company.

To effect a transfer of corporation ownership, one had to return the stock certificate to the corporation, then a new stock certificate in the new owner’s name (along with their number of shares) was issued. This was the formal legal process for transfer of fractional ownership in an entity. Even then, the transfer of stock certificates transpired through corporate lawyers.

Time was the problem in those days. A significant period of time (days to weeks) elapsed between:

the time the transfer occurred,

the paperwork creating the change of ownership,

the transfer of ownership authority from the principal (new or old owner) and their lawyer,

the transfer of paperwork from the owner to the company,

the administrative work at the company, and

the return of the new stock certificate to the new owner.

A better, faster, more efficient system was needed.

The Genesis of the Stock Certificate

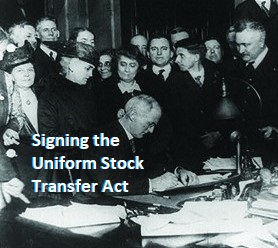

The Hoorn Chamber of the Dutch East India Company issued the first ever Stock Certificate on December 8, 1606. The first American stock certificates were adopted in the United States in 1800. It took one hundred ten (110) years for a solution to the time problem to be adopted. The Uniform Stock Transfer Act was passed in 1910, with later adoption by the States. This was an interesting change. The stock certificate became more like money, or a bearer bond.

The physical Stock Certificate started to carry on its back transfer of ownership language (much like today’s vehicle titles). A person who possessed an original Stock Certificate, with properly executed language and signature on the certificate’s back, was the fractional owner of the corporation, even though the corporation’s own books did not yet reflect that ownership transfer. Thus, the stock certificate as a “negotiable instrument” was born.

Common Use of Terms Between Crypto / Blockchain Tokens and Certificates of Stock

Cryptocurrency and blockchain businesses should find this development of particular interest. Blockchain businesses are founded on the decentralized accounting transfer of ownership of tokens, representing value. The transfer of blockchain value occurs between individuals and not a central authority.

The Uniform Stock Transfer Act similarly transferred ownership of value (fractional ownership in an entity) from a centralized process dictated by the entity in control to a decentralized function between individuals. What is more, even in 1910, the change was known as “a transferable token of stock interest!”

Historical Use of the term Fungibility

Not convinced of the analogy? Tokens on a blockchain that are equal and alike (ERC 20 tokens) are referred to as “fungible tokens.” Tokens on a blockchain that are unequal and unique (ERC 721 tokens) are referred to as “non-fungible tokens.” In 1910, with the adoption of the Uniform Stock Transfer Act, the language used was that stock interests were imbued with “fungibility.”

The term “fungible” derives from the Latin term fungibilis, or used in its active term fungi. It means to perform. The term “fungible” was used in relation to financial instruments by Anthony Ascham in 1649 in his book, Of Confusions & Revolutions. In 1681, J. Dalrymple described a Fungible item in his book, Instruments of Law of Sotland (at page 127) as being something that is the estimate of quantity, “the chief of which is Money.” Thus, the use of “fungible” as relating to finance and money is historical. The use of fungible in cryptocurrency has a sound and ancient basis.

Is there a connection between the concept of preferred stock and ERC 1155 tokens?

It is interesting to think about the analogy between preferred stock shares and ERC 1155 tokens. These are blockchain tokens representing a combination of unique digital assets (ERC 72 tokens) with “fungible” non-unique digital assets (ERC 721 tokens). Similarly, preferred stock certificates represent a combination of fungible stock ownership in a corporation without the voting rights associated with general stock ownership.

The Legal Framework of Stock Certificates

Article 8 of the Uniform Commercial Code (as adopted by the state) governs the law of the stock certificate. The Uniform Commercial Code does not, in and of itself, have legal authority. Rather, it is a legal framework (much like the Restatements) to be adopted by legal jurisdictions. State and Federal law comprises the legal authority.

What is or is not a Stock Certificate is governed by State law. Most States require a Stock Certificate to:

Every fractional owner of a company shall be entitled to a Stock Certificate,

Contain the State in which the company is chartered,

Name the Person to whom the stock is issued,

Signature

Corporate Seal

Contain the number of shares issues, and

Contain the class of the stock issued.

Contain a form to Transfer Stock Certificate Ownership

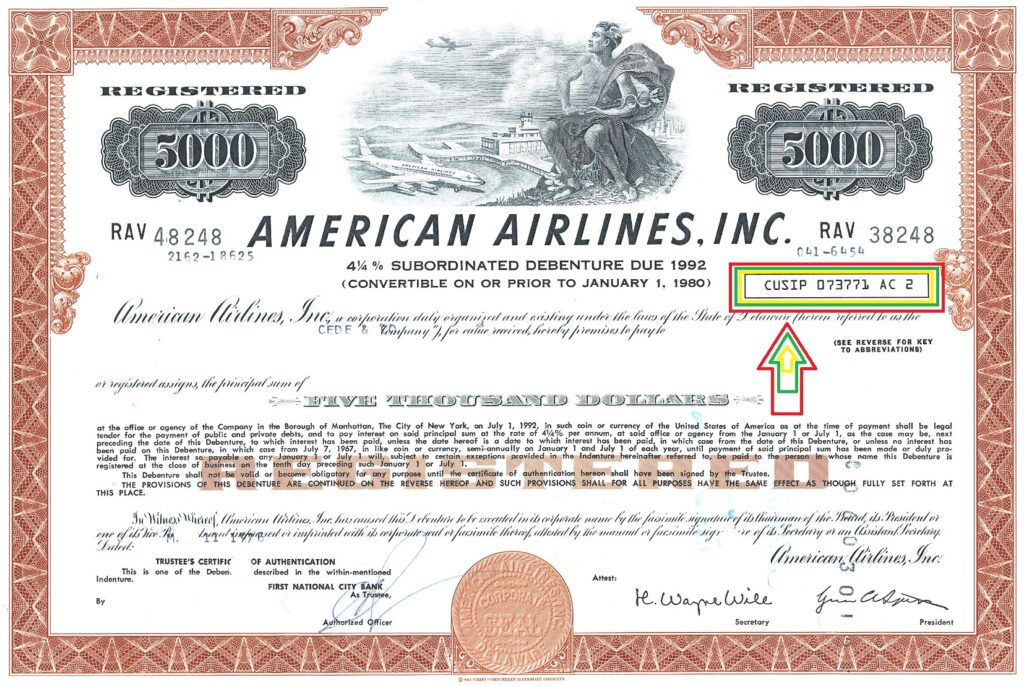

A CUSIP number

Corporation By-Laws, and Operating Agreements should reflect Stock Certificate requirements. By-Laws, and the Operating Agreement (resolutions) also commonly mandate the physical appearance details of Stock Certificates.

CUSIP Number

Stock Certificates nearly always show a tracking number. This is a Committee on Uniform Securities Identification Procedures number.

CUSIP numbers show on stocks and other convertible debts.(SAFE Notes, Convertible Notes).

A CUSIP number is nine (9) alphanumeric characters long.

The first six numbers of a CUSIP identify the unique name. The next two characters identify the type of instrument. The next characted is an auto generated check digit.

BIBLIOGRAPHY:

-

“The Transfer of Stock,” in Du Bois, Armand B., The English Business Company after the Bubble Act, 1720–1800 (New York, 1938), pp. 358–62Google Scholar, quotation from pp. 359–60.

-

Larson, Henrietta M., “A Medieval Swedish Mining Company,” Journal of Economic and Business History, vol. II (May, 1930), pp. 546–47.Google Scholar The history of this corporation with greater detail on its shareholding practices is contained in: Tunberg, Sven, Stora Kopparbergets historia: Förberedande undersökningar (Uppsala, 1922)Google Scholar, Söderberg, Tom, Stora Kopparberget under medeltiden och Gustav Vasa (Stockholm, 1932)Google Scholar, and Stora Kopparberg: Six Hundred Years of industrial Enterprise (Stockholm, 1960).

-

The history of this firm and its shareholding policies is covered in: Clemensson, Gustaf, Klippans Pappersbruk, 1573–1923 (Lund, 1923), esp. pp. 83ff.Google Scholar

-

Kellenbenz, Hermann (trans, and ed.), Confusion de Confusiones by Joseph de la Vega, 1688: Portions Descriptive of the Amsterdam Stock Exchange (Publication No. 13 of The Kress Library of Business and Economics, Boston, 1957), pp. 13n, xv.

-

Hoorn Chamber of the Dutch East India Company on December 8, 1606. It is in the possession of the Amsterdam Stock Exchange and has previously been published in The Analysts Journal, vol. XV (August, 1959), p. 17. An earlier certificate, issued September 27, 1606, by the Amsterdam Chamber is reproduced and annotated in Van Dillen’s, J. G., Het oudste aandeelhoudersregister van de Kamer Amsterdam der Oost-Indische Compagnie (The Hague, 1958), pp. 37ff.Google Scholar In printing, the Amsterdam and Hoorn certificates are identical except for the substitution of one city’s name for the other on line 2.

-

Krantz, Matt (25 May 2010). “Electronic records are replacing paper stock certificates”. USA Today. Retrieved 7 September 2010.

-

Ehrle, Clarence G. (January 1921). “The Uniform Stock Transfer Act”. Marquette Law Review. 5 (2): 91.

-

Loizos, Connie (6 March 2013). “Cofounded by Manu Kumar, eShares Aims to (Finally) Digitize Stock and Options Certificates”. PeHUB. Retrieved 13 June 2013.

-

"Note On Statutory Dematerialisation Across the European Union”. Retrieved 3 February 2015.

-

“DTCC Proposes Steps to Move Ahead on Full Dematerialization of Physical Securities”. 12 March 2013. Retrieved 3 February 2015.

-

“Electronic records are replacing paper stock certificates”. Usatoday30.usatoday.com. Retrieved 29 July 2022.

-

Miller, Todd (25 September 2015). “Why Private Companies Don’t Need To Issue Stock Certificates”. Retrieved 3 February 2013.

It will be the investors, auditors, and future owners who will see and possess your company's stock certificates. Image matters. Get this small but important detail right.