Cryptocurrency replacing money will not be blockchain’s the most transformative application. Rather, the largest change will be the movement of asset markets from the real world onto a blockchain. This is known as the “tokenization of real world assets.”

Is Asset Tokenization The Next Big Thing?

Many industry leaders tout the future of the tokenization of real world assets. Publications have extolled the RWA future as representing trillions of dollars of assets within the decade.

- Asset Tokenization: What It Is and How It Works, September 5, 2024, Chainlink, predicting the tokenization market at one hundred trillion dollars with real world asset values set by Chainlink oracles

- Standard Charter Reports $30 Trillion Tokenized Real-World Asset Markey by 2024, July 4, 2024, CryptoSlate, predicting tokenization will bridge the 2.5 trillion dollar global trade gap and a near future tokenized real world asset market value at fourteen trillion dollars. ($14,000,000,000,000.00)

- Real World Asset Tokenization: A Game Changeer for Global Trade, 2024 Standard Charter Bank, celebrating the Project Guardian Asset Backed Securities ABS from Singapore and expecting the overall tokenized real-world asset market at 30.1 trillion dollars by 2034. ($30,100,000,000,000.00)

- Your Complete Guide to Real-World Asset Tokenization, June 21, 2024, 4Ire, valuing the 2024 RWA market at five billion dollars and the 2030 tokenized real world asset at between eleven and sixty eight trillion dollars. ($68,000,000,000,000.00)

- How Is RWA (Real World Asset) Tokenization Disrupting Industries?, February 7, 2024, NASDAQ, predicting the real world asset tokenization will replace current real estate art, collectibles, and commodities markets.

- The Rise of Real-World Assets (RWAs) in DeFi: Key Players and Opportunities, April 10, 2024, AlphaPoint, citing the Boston Consulting Group / ADDX report predicting the tokenized asset market capitalization at sixteen trillion dollars by 2031. ($16,100,000,000,000.00)

- Tokenization of real-world assets: unlocking a new era of ownership, trading, and investment, October 13, 2024, Roland Berger, predicting a total market value of tokenized assets “significantly exceeding” ten trillion dollars by 2030. ($10,000,000,000,000.00)

The cryptocurrency industry is known for wildly optimistic predictions, but anticipating tens of trillions of dollars of market value within a mere six years demands a closer look. The authors of these predictions are some of the most prestigious, storied institutions in finance. Are the underlying presumptions of these predictions reliable?

What is Real-World Asset Tokenization?

Real World Asset Tokenization is a crypto industry term. It is the conversion of the ownership of a thing in the traditional world to a digital token on a blockchain.

There are Two Categories of Real-World Asset Tokenization

There are two categories of real-world asset tokenization initiatives. These initiatives aim to use digital tokens traded on a blockchain as:

- A digital blockchain token representing the value of an asset; essentially a derivative.

- A digital blockchain token being the ownership of the asset itself; essentially the digital blockchain token replacing the title, deed, stock certificate (physical OTC trading), or direct registration (stock ownership through a transfer agent).

Specific Types of Assets to Digitally Tokenize

Several asset types are considered ripe for tokenization on a blockchain. The most common real world asset tokenization targets include:

- Real estate: Land and structures permanently affixed to the land

- Infrastructure: Physical projects typically used as the subject of a revenue bond. Examples of infrastructure targeted for tokenization include airports, toll roads, museums, hospitals, and utility plants.

- Commodities: Tangible, physical goods of value that are substantially fungible, such as raw materials, and agricultural products (gas, gold, livestock, oil)

- Securities: Equity ownership in entities (company stock, LLC membership interest, investment contracts)

- Debt: A obligation to pay money evidenced by an instrument or contract, usually with an interest payment made over stated time periods.

- Physical art and collectible objects: Tangible objects with value derived from their aesthetic value, such as paintings, sculptures, etcetera

- Intellectual property: Intangible, non-physical items of value, such as trademarks, patents, copyrights, and trade secrets

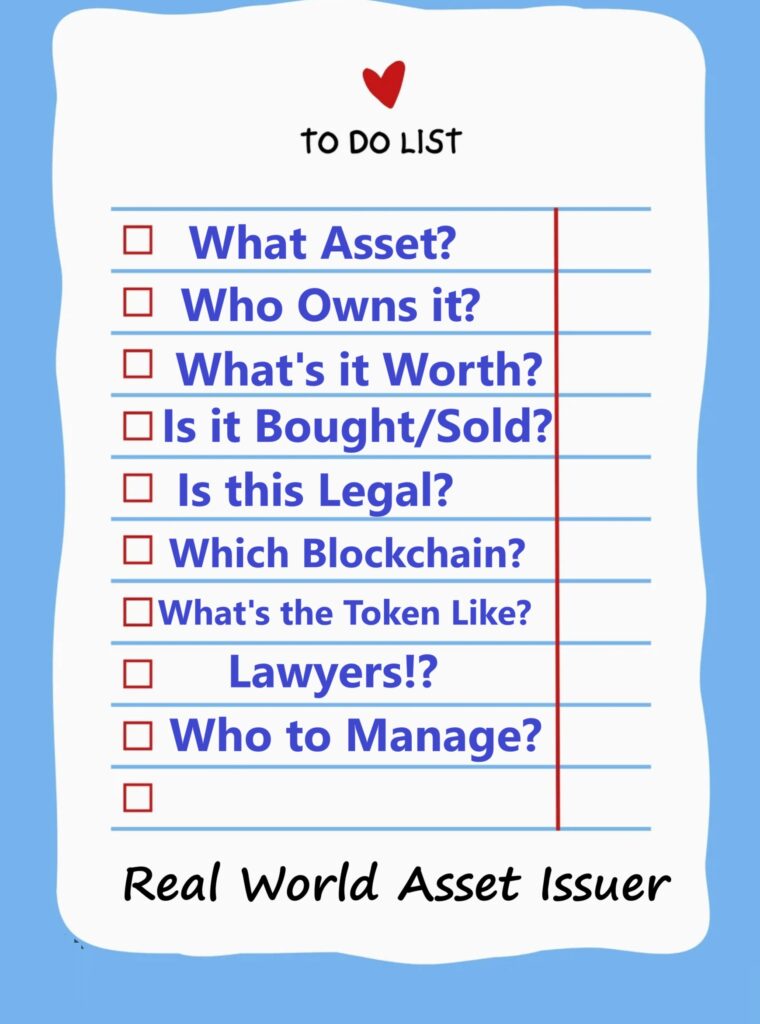

RWA: What Decisions Must Be Made Before an Asset can be Tokenized on a Blockchain?

- Determine what will be tokenized: The first step in the RWA tokenization process is selecting the asset. Consideration should be given to its potential market, its present legal ownership interests, and how token-friendly the asset will be.

- Ownership Investigation/Due Diligence: The asset’s ownership must be verified. Any claims or controversies in the asset’s provenance should be investigated.

- Value: The current fair market price of the asset should be determined.

- Liquidity: Some assets are commonly, easily traded on open markets. “Liquid” assets include government debt (Treasury Notes, Treasury Bill), commodities, and securities. Less liquid assets include real estate (+ REITs), many collectibles, art, and OTC “pink sheet” securities.

- Legal – Initial: A lawyers competent in the crypto industry should evaluate the initial legal and regulatory issues surrounding the asset’s tokenization (SEC registration, CFTC registration, recording of deeds, Secretary of State entity registration).

- Blockchain Selection: Different blockchains exhibit different characteristics and audiences. Some are more scalable. Others are more widely accepted. Some blockchains are expensive (gas). Others are more easily bridged to other blockchains. Thought needs to be given to the asset-blockchain marriage that will be most suitable.

- Token Attributes: The technical aspects of the token itself should be established. For example, it is common for an ERC-20 or ERC 721 on the Ethereum blockchain to be used due to its smart contract compatibility and popularity. The token’s rights, attributes, behavior, ownership, dividends, number, token number to be released, and release dates must be decided.

- Target Token Recipients/Buyer: Decisions must be made regarding what types of persons will receive or be eligible to purchase at the primary token offering. Issues may arise such as accredited investors under SEC Regulation D, country of residence of buyer issues, limits on when one may trade to the secondary market, limits on the amount of trading to the secondary market, and the steps necessary for a token purchaser to trade.

- Ongoing Legal Compliance: Most jurisdictions mandate ongoing legal compliance for market traded assets. The types of compliance steps that will be needed must be determined. The person or group that will do the work for ongoing legal compliance must be selected. How the compliance team will be compensated should also be decided.

- Management of the Asset: Real world assets require custody, storage, maintenance, and services. Buildings require repairs. Rent must be collected. Art must be secured. Commodities need to be stored. Intellectual property must be defended. The management of the physical aspect of the real-world asset tokenization will have to be managed.

Nine Barriers to Real-World Asset Tokenization

– Unsolved Problems –

The predicted market value of tokenized real-world assets stands at five billion dollars. Institutions predict this value will undergo an exponential rise into the trillions of dollars within a decade.

The realization of such predictions is not a mere matter of adoption. Daunting legal, technical, and human factors need to be overcome for the tokenization of real-world assets to reach its potential. Here are nine challenges that must be overcome for that goal to be reached:

- Challenge #1 Title Legitimacy: No significant restrictions exist to the creation of a blockchain token. Ownership provenance can be faked. Real legitimate ownership proof may be out of date (the asset sold to another party during the time between the trade and settlement).

- There may be multiple claims to the same asset (quiet title lawsuits). There may be no legal title ownership, at all (like for many commodities, and art). The mechanisms to verify current, valid ownership have not yet been devised.

- Challenge #2 Legal Ownership versus Token Ownership: There is presently no legally recognized commonality between the ownership of a digital asset (like an ERC-721 token) and a real-world asset (a Deed, Title, or CSD record, Central Securities Depository Clearing House). Some laws recognize the digital token as evidence of ownership; but evidence is not ownership itself.

- Some RWA schemes use entities that have Operating Agreements linking stock ownership of the entity to the digital token, when the entity owns the real-world asset. However, again, legally enforcing real world asset ownership with blockchain token ownership would require a court system, a lawsuit, then a judgment in one’s favor. Enforcing legal ownership from blockchain token ownership remains a challenge.

- Challenge #3 Owner Identification: Most legal jurisdictions require the asset owners to identify themselves. Deeds must be signed in person before a notary. Investors in securities may need to be accredited in advance. Tax laws require owners to be disclosed.

- Bank Secrecy laws require AML/KYC identification. Ownership identification requirements like these conflict with many aspects of the real-world asset marketplace. Sorting out ownership identification requirements and marketplace reality remains an unsolved challenge.

- Challenge #4 Technical Standardization: Interoperability issues exist between different blockchains due to the technical conditions upon which different blockchains are programmed. API Application Program Interfaces differ across platforms. Moreover, Web3 blockchains function very differently than legacy financial and legal systems. There is no one language or agreement on rules between asset networks. Standardization between blockchain and real world asset platforms will be needed and has not yet occurred.

- Challenge #5 Technical Standard Integration: Standardization between blockchain and real-world asset platforms may occur at some point in the future. However, adoption of these standards is likely to take time.

- There is always a gap between early adopters, the general field, and late adopters. An efficient Real World Asset tokenization on blockchains will require a robust ecosystem that has integrated its technical aspects. The delays in integration of standards should not be dismissed.

- Challenge #6 Liquidity: A touted benefit of the tokenization of real-world assets is the created availability of investments to investors who have been traditionally excluded. One may not have been able to invest in part of a $100 million dollar painting, or participate in sports team ownership, or own part of a beach in Brazil. The tokenization of real world assets makes exotic investing an option to masses of investors.

- The RWA remains in its infancy. Many markets for these assets are scarcely traded. Some of these assets do not yet have a market, at all. Liquidity risk has always been associated with categories of investments. However, this risk will have to be ameliorated for the RWA market to reach its potential.

- Challenge #7 Price Stability Between Blockchains: Arbitrage is the practice of buying and selling substantially the same in different markets to profit from price differences. Arbitrage is not just a way to make money. Arbitrage performs an essential market function … price stability. The tokenization of real-world assets remains in its infancy. There is no robust market for RWA trading and significant differences can exist between blockchains. An efficient RWA market will first need price stability between blockchains.

- Challenge #8 Price Reliability Between the Blockchain Marketplace and the Real World: Difficulty surrounds pairing the real-world value of a real-world asset and the price upon which the asset trades on blockchains.

- Speculation remains rampant in the cryptocurrency industry. Terms like HODL, and FOMO are indicative of price volatility. Crypto market price swings are complicated with real world assets represented on blockchains because RWA value is not set by the blockchain market alone, but by trading in real world markets. Pegging digital token values to real world asset values remains a problem for which there is not yet a solution.

- Challenge #9 Security: Scams and criminal activity have been hallmarks of the crypto industry since its inception. Security was a problem with the nascent internet, too. The security risk is heightened with crypto blockchains because they are novel, technical, allow for identity obfuscation, and global.

- Bad actors can steal with relative impunity when they operate from lightly enforced jurisdictions. Real world asset platforms need standards and ongoing cybersecurity to identify, avoid, and a means of resolving security issues as they will be ongoing. The market for tokenized real world assets will not reach its potential until it becomes secure.

In Closing

Real-world asset tokenization seems inevitable. RWA will find digital blockchain ledgers to be an essential ingredient in their investing ecosystem. Like many innovations, exuberance exists regarding early importance and quick adoption. The reality is that decades may pass before an innovation flowers to its potential.

We experienced this optimism with the creation of virtual reality in the 1980s. We experienced this optimism with the expansion of the internet in the 1990s. From the 2000s, cryptocurrency was supposed to have replaced money by now.

The tokenization of real-world assets is projected to supplant legacy asset markets within ten years and represent trillions of dollars in market capitalization. The truth is that complex, difficult barriers remain to be overcome before RWA’s promise becomes reality. Let us recognize these challenges, and begin.

Trial lawyer Matt Hamilton graduated from the University of Missouri in 1995 with Science degrees in Logistics, Marketing, and Business Administration. Juris Doctor, 1999.