The simple agreement for future tokens

The simple agreement for future tokens

what is a s.a.f.t. agreement?

The crypto lawyers at Whale.Law draft SAFTs (Simple Agreements for Future Tokens) between cryptocurrency businesses and their investors.

SAFTs are contracts, often involving accredited investors according to Regulation D of the Securities and Exchange Commission, who wish to invest in blockchain startup, small, and medium sized businesses.

In the SAFT, the investor is not buying cryptocurrency. Rather, the investor is buying the right to purchase cryptocurrency, in the future, at a defined time, and price. Investors do not get a token for their money. Investors get the right to a token when one is issued.

Why a Simple Agreement for Future Tokens?

The SAFT was created to allow startup crypto businesses to raise capital and yet avoid violating United States SEC securities regulations. The importance of the SAFT, because the investor has a delay before the ICO, the investor can anticipate a higher return. This is because the SAFT allows the project to be more “fully baked” before an investor return becomes available.

how do Investors Benefit from a SAFT?

Special rules in various countries investors who meet specific criteria to enter the market early, creating an opportunity for an extraordinary return. Each SAFT investor must meet certain requirements. These special investors have different titles, depending upon the country. For example:

-

Accredited Investor (Canada)

These investors differ from retail buyers on the open market.

There are several Types of SAFT agreements

There are multiple types of SAFTs. Types include:

-

SAFTs for cryptocurrency pre-sales (pre ICO – Initial Coin Offering)

-

SAFTs for cryptocurrency, with a price discount only

-

Post-Money SAFTs

-

Post Money SAFTs for an MFN only (this is a notice the business issues in case a subsequent convertible security is issued with terms more favorable than the SAFT)

-

SAFTs with a Pro Rata side letter

-

SAFTs with a Valuation Cap

-

A Cayman Islands compliant SAFT

-

A Canada compliant SAFT

-

A Singapore compliant SAFT

Each business seeking to raise capital through an investor (or group of investors) must not only comply with SEC Regulation D, but must also choose to have its crypto blockchain lawyer draft a Simple Agreement for Future Tokens that is appropriate for the circumstances.

S.A.F.T. Benefits and Deficits

There are benefits and deficits with SAFTs. The main benefit of the SAFT is the ability to raise capital before an initial coin offering (ICO). The main deficit of a SAFT is the risk that the cryptocurrency becomes a security as defined by the Securities and Exchange Commission (SEC), irrespective of whether the crypto business views it as a utility token, or otherwise.

It is important to note; the SAFT does not typically give an ownership interest in the crypto business. It is simply a right to purchase a set amount of cryptocurrency, at a set price, at a set point in the future, in exchange for money now. The issuing cryptocurrency company typically remains free to sell other SAFTs (or equity) to other investors. Risk remains; investors risk that the project will not get to its full ICO phase.

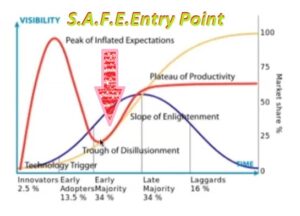

Historical Returns on Investment – The S.A.F.E. (Pre – S.A.F.T.)

Web3 – SAFT Returns on Investment (Post – S.A.F.T.)

In Web3, the SAFT differs from the SAFE (traditional venture capital investing). For blockchain/cryptocurrency startup companies, the SAFT takes the SAFE a step earlier. There are, now, two cap tables in Web3:

-

Equity Cap table

-

Token Cap table

The SAFT offers investment funds to crypto companies earlier in the startup process. Investors like SAFTs as they allow for greater returns on capital at lower prices.

The Contents of a SAFT

Essential SAFT Terms:?

-

The Amount paid by the buyer

-

When the buyer is to pay

-

That the Crypto Business is giving the buyer the right to cryptocurrency

-

The Type and Amount of Cryptocurrency to which the buyer is entitled

-

When the buyer is to get the cryptocurrency

-

The Discount Rate for the buyer (the reduced price the buyer gets at ICO)

Optional S.A.F.T. Terms:

-

The buyer’s duty to complete and give any documents needed to complete the transaction, such as compliance with Anti-Money Laundering laws and SEC regulation

-

What happens if the crypto business becomes insolvent (bankrupt) before the cryptocurrency ICO

-

That there are not any undisclosed steps needed to perform the Agreement terms

-

A Stipulation that Management Control is not given

-

Country Specific Notices to comply with country specific laws, like for the United States, Canada, the Cayman Islands, the United Kingdom, Switzerland, Singapore, etc.

-

A Severability Clause

-

An Entirely Clause

-

A Choice of Laws provision

-

An Election of Venue

Each party considering a SAFT should meet with their blockchain lawyer so that the legal requirements are met. Also, the SAFT needs to be drafted to fit the specific circumstances between the parties.

How do Cryptocurrency Businesses Divide Tokens with a SAFT?

SAFTs Complicate Token Supply, Use, and Risk.

There are three complicating factors for tokenomics when a crypto business uses a SAFT for investment funds.

-

Legal: Limits arise with the use of the crypto token because of SEC securities laws

-

Supply: limitations arise with the value of the tokens being investments

-

Use: limitations arise with the tokens being securities

In practice, it is common to see the following S.A.F.T. token distribution. Tokens, typically, half will go to the community (for liquidity and funds), one quarter will go into the treasury, and one quarter will go to early investors via a S.A.F.T. contract.

A S.A.F.T. may Create a Security Subject to S.E.C. Rules

There are many types of cryptocurrency tokens. Whether a cryptocurrency token is deemed an “investment contract” (in other words, a “security”) by the United States’ Securities and Exchange Commission is a test set out in the California case of SEC v. W.J. Howey Co., 328 U.S. 293 (1946). A cryptocurrency becomes a security under the Howey test when it meets the following criteria:

-

There is an investment contract (such as a SAFT)

-

The parties are agreeing to form a common enterprise

-

The issuer is promising profits

-

A third party is promoting the offering

Keep in mind; the result of a Howey test analysis is not so simple. Within these four elements, the SEC includes 38 considerations. Many of the 38 Howey considerations include multiple sub-parts that influence whether or not the Howey test is met. You will need a lawyer versed not only in current SEC application of its laws, but also in the crypto industry to achieve a reasonably accurate prediction of how the SEC will consider your cryptocurrency.

Any business at its inception that sells an investment contract is likely to be deemed a security. The SAFT closely resembles a securities purchase agreement (like for common stock). After the SAFT, a crypto business should expect legal issues, as it is likely the SAFT cryptocurrency will forever after be deemed a security. It must comply with SEC regulations. It is:

-

No longer merely a cryptocurrency

-

No Longer merely a license

-

No longer merely a utility token

The DAO Report

Perhaps the most famous application of the Howey test in the blockchain industry occurred on July 25, 2017. The SEC considered the Decentralized Autonomous Organization known as the DAO. The Report of Investigation of the DAO concluded it was a security subject to the requirements of the Securities Exchange Act of 1934. No SAFT was present in the DAO report, which implies cryptocurrency can be deemed a security even when an investment contract like a SAFT is not present.

The proper drafting and execution of a SAFT is a specialized skill for a crypto lawyer. The SAFT has gone “out of vogue” with standard “form” SAFTs now carrying with them a risk too high for many. Special attention needs to be paid so that the business is not in violation of SEC rules, and criminal law.

Contact Us, the blockchain crypto lawyers at Whale.Law to guide you through the startup investment process if a SAFT is a method you consider.

Let's talk. Your business need investments to grow. Money infused through an agreement for future crypto tokens is a great way to raise capital on a budget.

Trial lawyer Matt Hamilton graduated from the University of Missouri in 1995 with Science degrees in Logistics, Marketing, and Business Administration. Juris Doctor, 1999.